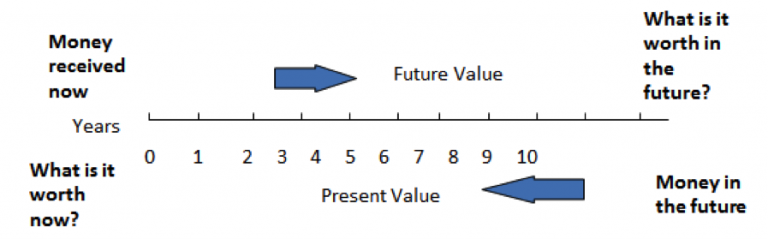

The formula used for compounding can also be used to find the initial principal.

This formula is rearranged to find the initial principal of an accumulated sum.

From the compound interest formula we know:

Accumulated Value (S) = P (1 + i) ⁿ

Where

P = Principal

i = interest rate for each period

n = the number of periods

We can rearrange the formula to find P (the principal) when we know what the accumulated value (S) is.

- S = P (1 + i) ⁿ

- S = P

- (1 + i) ⁿ

- S (1 + i)¯ⁿ = P

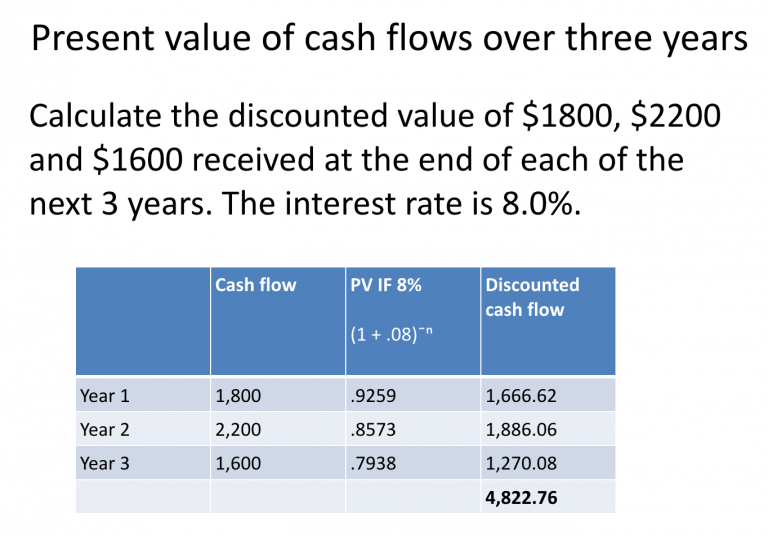

Let’s look at these examples

What is the present value (value today) of $5,000 when;

1. Interest is 2.5% and the money is received in 8 years time?

5,000 x (1 + i)¯ⁿ

5,000 x (1.025) ¯ⁿ where n = 8

5,000 x .8207 = $4,103.50

2. Interest is 10% and the money is received in 6 years time?

5,000 x (1 + i)¯ⁿ

5,000 x (1.1) ¯ⁿ where n = 6

5,000 x .5645 = $2,822.50